Toyota Tundra Depreciation

Its for all of these reasons that the Toyota Tundra is the Full-Size Truck Best Resale Value Award winner for 2021.

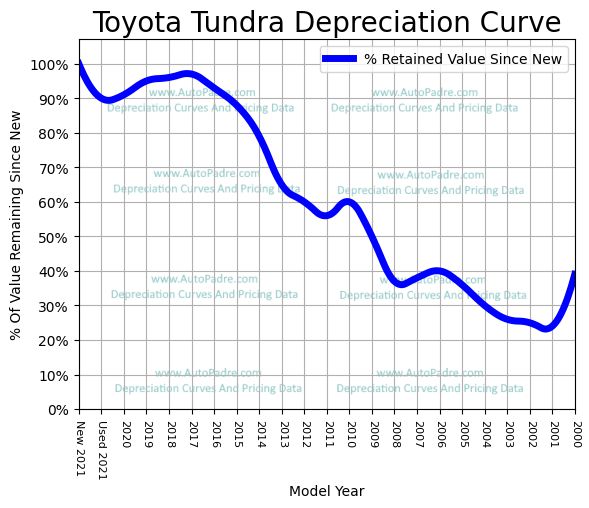

Toyota tundra depreciation. Section 179 Deduction limit after adjustment for inflation has increased to 139000 maximum allowance would have been only 25000 prior to the new legislation. 31 Leveling Lift Kit 20X9 Fuel Assaults 1 29560R20 Falken Wildpeak AT3W. Toyota vehicles have an average depreciation in the first three years from new of 35 percent.

Toyota as a brand does very well in maintaining its value consistently ranking at the top of popular brands. The 2020 Toyota Tundra True Cost to Own includes depreciation taxes financing fuel costs insurance maintenance repairs and tax credits over the span of 5 years of ownership. Business Use Tax Deduction on vehicles Section 179.

Ranked at 5 is Toyota Tundra at 327 average depreciation. Cost to own data is not currently available for the 2009 Toyota Tundra Double Cab-V8 Dbl 47L V8 5-Spd AT SR5. The Tundra also made iSeeCars list of top 10 vehicles with the lowest depreciation placing fourth.

Howdy i wanted to hear what kind of depreciation numbers you folks were you seeing when you traded in or sold your 3rd Gen Tundra. All these play into why the Toyota 4Runner is really good at resisting depreciation. Average 5-year depreciation difference 1.

Jeep Wrangler 328 10824 4. Car Depreciation Comparison Charts for Toyota 4Runner vs Toyota Tundra vs Toyota Tacoma vs SUV The first chart below shows the percent deviation between the Industry Average the Toyota 4Runner the Toyota Tundra the Toyota Tacoma and SUV with years in age as the intervals. Please state your length of ownership and how much was lost since your purchase.

Understanding Depreciation Buying a pre-owned car for sale isnt the first choice for everyone but its definitely a smart move if youre cutting on costs. Toyota Tundra The Tacomas bigger sibling the Tundra comes in at number three on the list. IRS Section 179 depreciation deduction.